✅ WE LIKE:

Vanguard cleverly uses heartfelt family imagery to inspire viewers to associate the brand with securing a happy, stable future for their loved ones.

Zero In on High-Value Clients you want to attract

To make Google Ads truly profitable for financial advisors in 2026, you need to go far beyond surface-level targeting.

Success doesn’t come from casting a wide net—it comes from strategically zoning in on the exact type of clients who bring long-term value to your advisory practice.

That means understanding your ideal client’s demographics, search intent, and financial pain points, then translating that into the right targeting and keyword strategy.

Define Your Most Valuable Client Segments

Before writing a single ad, ask yourself: Who do I want to manage money for? Your client base may vary widely, but some high-value segments to consider include:

- Pre-retirees (ages 50–65) with $250k+ in investable assets

- Newly wealthy professionals (tech, law, medicine) in major metro areas

- Small business owners needing tax and succession planning

- Executives rolling over large 401(k)s

- Women in transition (divorce, inheritance, retirement)

Each of these audiences has distinct needs—and different search behaviors. Your Google Ads success depends on matching that with the right messaging and targeting.

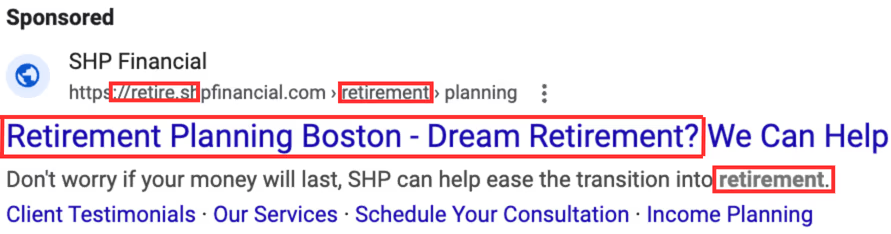

✅ WE LIKE:

A clear focus by SHP Financial on a specific segment—people who are retired or nearing retirement—paired with careful attention to details like the display URL and description.

Use Detailed Demographic Targeting

In Google Ads, Demographics → Detailed Demographics lets you target by:

Household income tiers (top 10%, 11–20%, etc.)

Parental status (for education or legacy-focused messaging)

Age brackets (vital for tailoring retirement vs. growth content)

For example:

Target ages 45–64 with retirement-focused offers like “Maximize Your 401(k) Before Retirement.”

Use Top 10% income targeting in affluent zip codes for wealth management services.

Build Keyword Sets Based on Intent, Not Just Industry

Instead of generic terms like “financial advisor,” focus on high-intent queries that reflect urgent financial needs.

High-Intent Keywords:

“fee-only financial advisor near me”

“retirement planner for doctors”

“independent financial advisor for business owners”

“fiduciary investment advisor $500k minimum”

“wealth management after divorce”

Here are 50 keywords to consider as a financial advisor that wants to generate leads

| Keyword | Monthly Searches (USA) |

|---|---|

| financial advisor | 246000 |

| financial planner | 135000 |

| financial advisors near me | 49500 |

| investment advisor | 33100 |

| robo advisor | 27100 |

| certified financial planner | 22200 |

| financial planner near me | 18100 |

| fiduciary financial advisor | 9900 |

| independent financial advisor | 9900 |

| wealth management firms | 8100 |

| wealth management services | 8100 |

| best financial advisors | 6600 |

| wealth advisor | 6600 |

| personal financial advisor | 5400 |

| registered investment advisor | 5400 |

| fee only financial planner | 3600 |

| financial advisor cost | 3600 |

| financial advisory services | 3600 |

| financial planning services | 2900 |

| find a financial advisor | 2900 |

| retirement planning advisor | 2900 |

| top wealth management firms | 2900 |

| how to choose a financial advisor | 2400 |

| top financial advisors | 2400 |

| best retirement financial advisors | 1900 |

| financial advisor companies | 1900 |

| online financial advisor | 1900 |

| retirement financial planner | 1900 |

| what does a financial advisor do | 1900 |

| best certified financial planner | 1600 |

| financial advice near me | 1600 |

| financial advisor for retirement | 1600 |

| financial planning near me | 1600 |

| local financial advisor | 1600 |

| personal finance advisor | 1600 |

| 401k financial advisor | 1300 |

| business financial advisor | 1300 |

| fee based financial planner | 1300 |

| financial advisor firm | 1300 |

| financial advisor for young adults | 1300 |

| independent financial planner | 1300 |

| investment management advisor | 1300 |

| retirement investment advisor | 1300 |

| college financial advisor | 1000 |

| fee only investment advisor | 1000 |

| financial advisor consultation | 1000 |

| financial advisor help | 1000 |

| find fiduciary financial advisor | 1000 |

| independent wealth advisor | 1000 |

| low cost financial advisor | 1000 |

| virtual financial advisor | 1000 |

Pro Tip: Layer Location, Income, and Keyword Intent

Google Ads lets you combine multiple signals. A winning structure might look like this:

Location: target zip codes in affluent suburbs (e.g., Greenwich CT, Palo Alto CA, Naples FL)

Income: top 20% income bracket

Keyword: “fiduciary retirement advisor near me”

This layered approach filters out window shoppers and attracts only those likely to convert into AUM.

Stand Out with Positioning That Speaks to Your Niche

In a crowded market, financial advisors who blend in get ignored. Your credentials might be solid. Your experience might be deep.

But if your positioning is too broad—“I help people plan their finances”—you’ll struggle to attract the right leads, no matter how optimized your Google Ads are.

Clients aren’t searching for a “generalist.” They’re searching for someone who understands their unique situation.

Why Niche Positioning Drives Better Results

Google Ads works best when your value proposition matches the exact intent of the person searching. That’s nearly impossible if you’re trying to appeal to everyone.

Niche positioning:

Makes your ads instantly more relevant

Increases click-through rates by aligning with search intent

Pre-qualifies leads before they ever hit your website

Real Niche Examples That Attract High-Intent Clients

Here’s how positioning by niche can turn a basic financial advisor offering into a client magnet:

Crypto Wealth Planning

“I help crypto investors turn digital gains into long-term wealth.”

Targets tech-savvy, high-net-worth individuals who need help with tax planning, volatility management, and conversion into traditional portfolios.

Advisors for Physicians

“Specialized retirement and tax planning for doctors.”

Medical professionals have high income, low time, and unique needs around debt, liability, and long-term care. Positioning directly to them increases trust and credibility.

Exit Planning for Business Owners

“Succession and investment strategies for business founders.”

Business owners nearing retirement are often sitting on 7–8 figure assets they need to convert into income streams. This niche allows you to offer multi-layered planning services.

Divorce Financial Planning

“I help women build financial independence after divorce.”

This niche speaks to emotional needs as well as financial ones—an underserved but highly motivated audience.

Advisors for Millennials with Stock Options

“Helping tech employees optimize RSUs, ESPPs, and early exercise.”

Hyper-specific and perfect for clients in startup-heavy markets like SF, Seattle, or NYC.

What This Means for Your Ads

Once your niche is clear, you can tailor every part of your campaign—from keywords to landing pages—to speak directly to that audience.

For example:

Instead of bidding on “financial advisor,” bid on “crypto financial planner” or “RSU tax strategy.”

Instead of a generic landing page, show testimonials from people in that niche.

The more specific your positioning, the less you need to “sell.” The client already feels seen.

A well-crafted, niche-targeted search ad designed specifically for individuals who are about to divorce or have recently divorced (by Certuity).

Make It About Them, Not You: Client-Centered Messaging

One of the biggest mistakes financial advisors make—especially when running Google Ads—is writing messaging that sounds like a résumé.

“I’m a CFP® with 15 years of experience.”

“I offer holistic, personalized financial planning.”

“I help clients achieve their goals.”

That’s not messaging. That’s your story. What prospects want to know is:

“What’s in it for me—right now?”

Understand Their State of Mind

Most people don’t search for a financial advisor out of curiosity—they search because they’ve hit a trigger:

They’re about to retire and don’t know if they can afford it.

They just sold a business and don’t want to blow the money.

They inherited wealth and are afraid of making a mistake.

They’re maxing out income but feel lost financially.

Your messaging needs to meet them where they are—not where you are.

Examples of Client-Centered Messaging That Works

Let’s break it down. Here’s what advisors think sounds good… versus what actually resonates.

Instead of:

“We provide comprehensive wealth management solutions.”

Say:

“Worried your investments aren’t working hard enough? Let’s fix that.”

Instead of:

“I specialize in tax-optimized portfolio strategies.”

Say:

“Keep more of what you earn—without spending hours on spreadsheets.”

Instead of:

“We help high-net-worth clients plan for the future.”

Say:

“Just sold your company? Here’s how to turn a one-time exit into lifelong income.”

Focus Every Message on One Thing: Their Desired Outcome

Whether you’re writing headlines, landing page copy, or ad descriptions, always anchor your message to the client’s goal or fear. Not your process. Not your background. Their pain or dream.

Ask yourself:

What is the client trying to avoid?

What result do they crave?

How does working with you change their life?

Then write directly to that.

Tailor Your Messaging to the Niche

If you’re targeting physicians, don’t say “retirement planning services”—say “You’ve spent your career saving lives. Now let’s secure your future.”

If you’re targeting crypto investors, don’t say “diversified portfolios”—say “Turn volatile gains into long-term wealth.”

Make every word show that you understand their world.

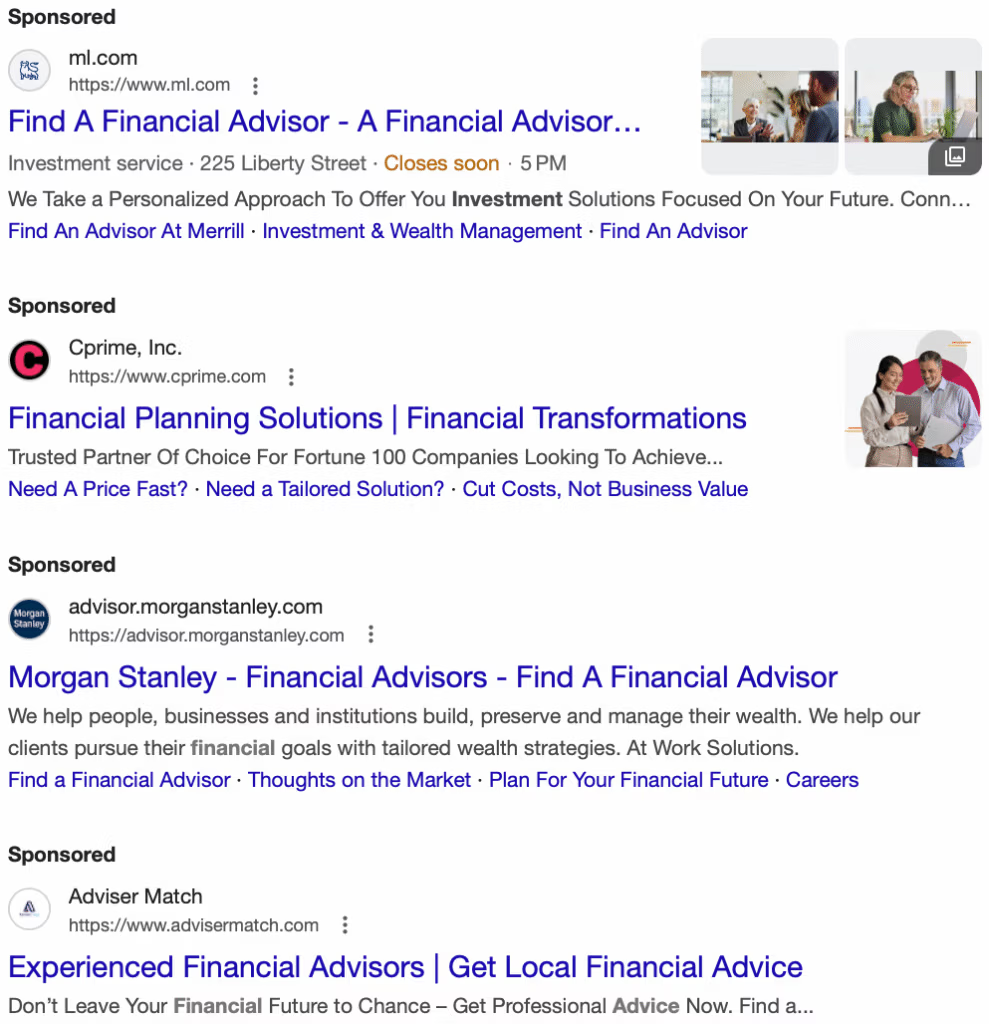

❌ WE DON’T LIKE

All these ads suffer from painfully generic headlines—lacking both creativity and emotional pull.

This opens up a major opportunity to stand out with a headline that’s not just different, but laser-focused on the actual benefit the prospective client is looking for.

A headline that speaks directly to their goals, fears, or aspirations could instantly cut through the noise.

Build the Trust They Need Before They Call You

Trust is not optional in the financial advisor business—it’s everything. You’re asking people to hand over control of their life savings, their retirement plans, and their financial future.

If they sense even the slightest red flag, they’ll bounce. That trust-building process starts before they ever meet you—in your ads, landing pages, and overall content.

In 2026, prospects are more skeptical and better informed than ever. They’ll Google your name. They’ll judge your website in five seconds. And if your messaging sounds too generic, too salesy, or too templated? They’re gone.

Why Trust Matters Even More in Google Ads

When someone clicks your ad, they’re making a micro-commitment. But if what they see next doesn’t immediately reinforce trust, they won’t go any further.

The trust gap is even wider in financial services because:

The stakes are high—retirement, taxes, investments, legacy

There are too many unlicensed or conflicted “advisors”

Prospects worry about hidden fees, sales pressure, or bad advice

Your content must close that trust gap fast.

6 Trust Signals Financial Advisors Should Embed in Their Ads & Landing Pages

1. Show Credentials—but Don’t Rely on Them Alone

✅ Display “CFP®,” “RIA,” “Fiduciary” clearly

✅ Briefly explain why that matters (e.g. “Legally obligated to act in your best interest”)

2. Use Specific Testimonials and Case Studies

✅ “David helped me secure my retirement after selling my business” is 10x better than a generic quote

✅ Always include first name, age range, and situation

3. Display Real, Approachable Photos

✅ Include your face—not a stock photo of a handshake

✅ Add a warm, professional headshot and optionally your team

4. Show Transparency Around Fees

✅ “Fee-only, no commissions” builds instant credibility

✅ Include ranges or structures (“Flat fee, no % of assets under $1M”)

5. Highlight Regulatory Disclosures Smartly

✅ Link to your ADV Part II or include “SEC Registered RIA”

✅ Mention fiduciary duty in plain language

6. Lean Into Social Proof & Recognition

✅ “Trusted by 150+ clients in Atlanta since 2009”

✅ Add media features or awards if real (e.g. “Featured in Forbes Advisor”)

How to Apply This in Your Ad and Landing Page Copy

Ad Example:

“Fee-only fiduciary. No commissions, ever. 1-on-1 planning for tech professionals ready to retire early.”

Landing Page Headline Example:

“You deserve advice from someone who doesn’t sell products.”

(Followed by a testimonial and credentials block.)

It’s essential for your landing page to clearly showcase the financial advisors on your team and their credentials—transparency here builds trust and credibility.

(By Epwealth)

An impactful strategy: showcasing the logos of media outlets that have featured the firm, each linked to the corresponding article

By Earned.com

Choose the Right Format to Deliver the Right Message

When marketing as a financial advisor, what you say is important—but how you say it can make or break performance.

In Google Ads, this means choosing the most effective format and campaign type for each stage of your audience’s journey.

Some messages belong in a short search ad. Others demand a video explanation or a trust-building article.

If you’re still using only Search campaigns with a few lines of text, you’re missing out on a much bigger opportunity to build relevance, trust, and authority across the funnel.

Match Message Format to Client Intent

Different prospects need different formats depending on where they are in their decision process:

1. Ready-to-act prospects

→ Use Search Ads with text-based, offer-driven messaging

Example: “Fee-Only Financial Advisor – Schedule Your 15-Min Intro Call”

2. Curious or comparison-stage users

→ Use Demand Gen or YouTube Ads to educate and warm them up

Example: Video: “How to Know If a Fiduciary Advisor Is Right for You”

3. Passive but qualified users

→ Use Display Ads with testimonials, firm differentiators, and retargeting

Example: Banner: “Serving 150+ Clients in Denver – 100% Fiduciary Advice”

Here’s How Different Formats Work for Advisors

Search Ads (Text-based)

Best for: capturing high-intent traffic

Use for:

“Fee-only financial advisor near me”

“Retirement planning advisor Boston”

Focus on: location, offer, and trust

➡️ Great for driving appointment-based conversions

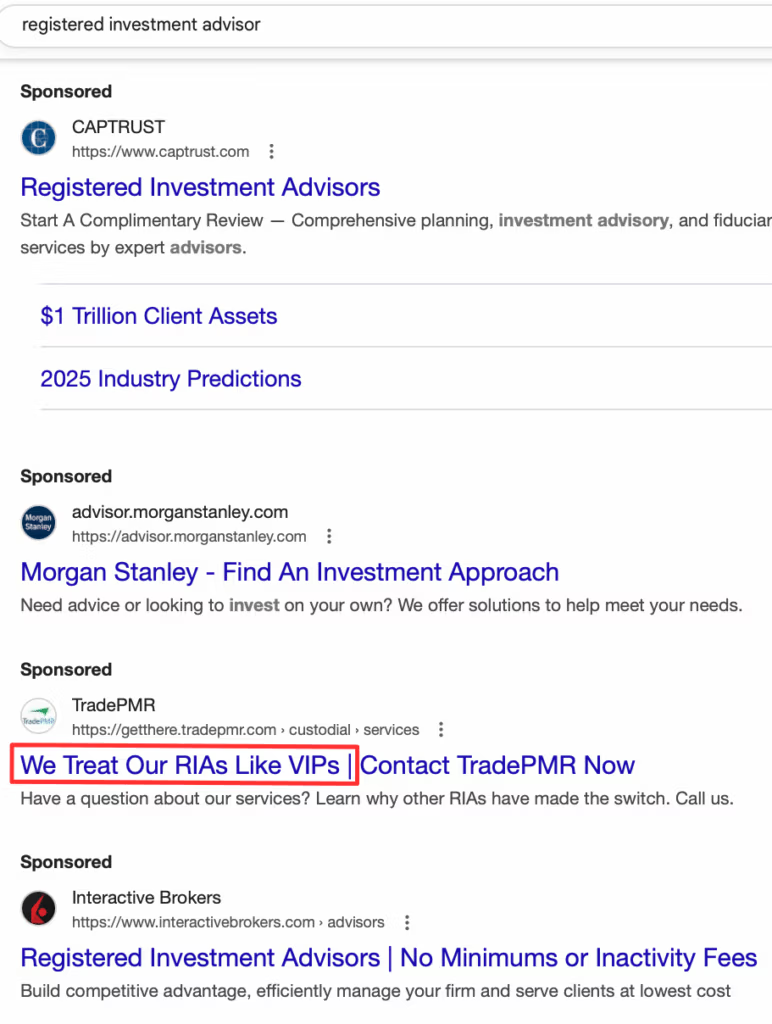

✅ WE LIKE:

While the headline “We treat our RIAs like VIPs” may not be perfectly aligned with a higher-income audience, it does have the advantage of standing out—making it likely to draw a fair share of clicks for that very reason.

By TradePMR

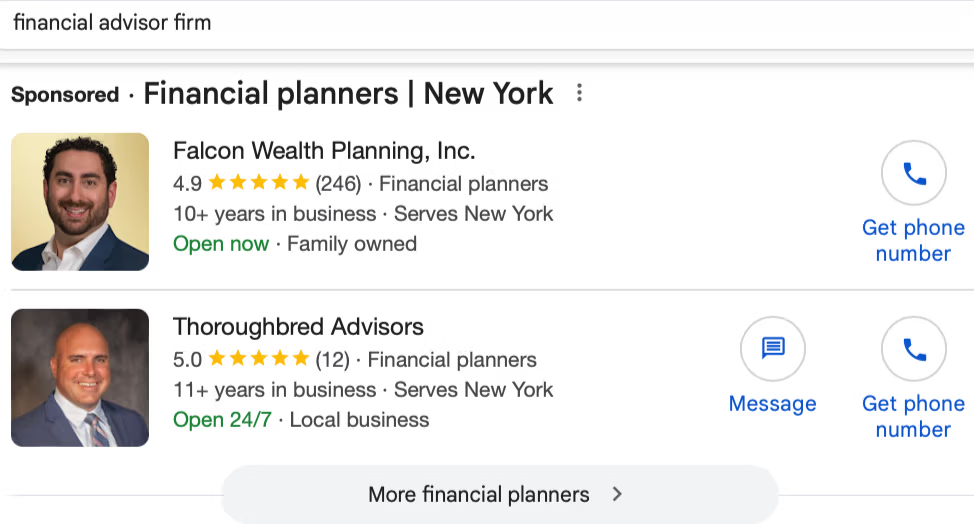

Local Services Ads (LSAs)

Best for: Advisors with a physical office targeting local, high-intent leads

How it works:

LSAs appear at the very top of Google search results, even above standard text ads. They show your name, photo, rating, and “Google Screened” badge, adding instant trust. You only pay per lead, not per click.

Use for:

Local intent searches like “financial advisor near me”

Boosting visibility and trust in your ZIP code or city

Capturing leads who want to call or message directly from Google

Tip:

To run LSAs, you must pass a background check and be approved through Google’s “Google Screened” program. Be sure to include clear categories like financial planner, investment advisor, or retirement planner depending on your practice.

Thanks to their prime placement at the very top of the search results, LSAs are a no-brainer for financial advisors.

That said, building a strong base of 5-star reviews is essential—not just to boost your LSA performance, but also to strengthen your Google Business Profile, which appears in the local pack and heavily influences trust and click-through rates.

YouTube Ads (Video)

Best for: building authority and trust through visual presence

Use for:

Explaining fee structures

Showing personality

Simplifying complex topics like tax or estate planning

Tip: Even a 60-second video with your face and voice can outperform polished stock footage

✅ WE LIKE:

This video ad works thanks to its entertaining content, which keeps viewers engaged, and also because the analogy clearly reflects the financial risks you want to avoid.

By CFP

✅ WE LIKE:

In-Feed Video Ads like this one allow you to appear right at the top of YouTube search results—a powerful advantage when you consider that YouTube is the second-largest search engine in the world.

For financial advisors, this means you can position your content in front of high-intent users actively searching for terms like “how to rollover a 401(k)” or “best retirement strategies.”

Display Ads (Banners)

Best for: brand recall and retargeting warm users

Use for:

Reminding visitors who didn’t book

Highlighting credentials/testimonials

Tip: Include a headshot, credential badge (CFP®, RIA), and benefit-driven CTA

A compelling display ad that highlights expert content—designed to move prospects into the conversion funnel—paired with an inspiring image of a loving family.

Demand Gen Campaigns

Best for: top- and mid-funnel education

Use for:

Promoting gated guides like “401(k) Rollover Checklist”

Driving traffic to trust-building content pieces

Tip: Layer audiences (e.g. age 45–65, high income, interest in investing)

Control Costs Before They Control You

Google Ads can absolutely deliver high-quality leads to financial advisors—but if you don’t control your costs, it can also burn through your marketing budget in a matter of days with nothing to show for it.

Why is this so critical in the financial advisor space? Because:

Clicks in this industry are expensive ($6–$30+ per click is common)

Lead quality is inconsistent unless your targeting and messaging are dialed in

Conversion cycles are long—you’re not selling sneakers, you’re earning trust

One week of sloppy campaign management can cost more than a client is worth in their first year. That’s why cost control isn’t optional—it’s survival.

Here are some sample keywords along with the estimated cost-per-click to appear at the top of the search results:

Let’s start with the most general keyword in the industry:

| Keyword | Avg. monthly searches | Top of page bid (low range) | Top of page bid (high range) |

|---|---|---|---|

| financial advisor | 165000 | 9.12 | 25.53 |

Fairly expensive for a keyword where it’s unclear whether users are actually seeking a financial advisor—or simply looking up the definition

Let’s get more specific with higher intent keywords:

| Keyword | Avg. monthly searches | Top of page bid (low range) | Top of page bid (high range) |

|---|---|---|---|

| financial advisors near me | 74000 | 7.00 | 28.21 |

| unbiased financial advice | 320 | 8.00 | 30.08 |

| find a financial advisor | 1900 | 14.09 | 44.21 |

| financial advisor consultation | 480 | 14.42 | 58.24 |

It’s clear that the stronger the buying intent, the higher the cost per click.

Here are a few interesting niche keywords:

| Keyword | Avg. monthly searches | Top of page bid (low range) | Top of page bid (high range) |

|---|---|---|---|

| retirement financial advisor | 6600 | 4.24 | 23.47 |

| real estate financial advisor | 6.75 | 25.20 | |

| investment advisor | 8100 | 8.21 | 26.06 |

| debt advisor | 1300 | 10.16 | 30.20 |

| wealth advisor | 5400 | 13.72 | 33.60 |

| financial advisor and tax consultant | 110 | 14.53 | 44.78 |

| expat financial advisor | 210 | 9.00 | 47.17 |

Niche keywords offer the best ROI for your business, but due to their cost, they must be selected with great care.

5 Common Budget Pitfalls for Financial Advisors

1. Bidding on Generic Keywords

Keywords like “financial advice” or “money tips” are broad, low-intent, and expensive.

Fix it: Use tightly focused keywords like “fee-only retirement planner Boston” or “fiduciary advisor $500k minimum”.

2. No Geo Targeting

Showing your ads to users in cities you don’t serve = wasted spend.

Fix it: Restrict targeting to high-value zip codes or a tight radius around your office.

3. No Negative Keywords

Without negatives like “free,” “entry-level,” or “jobs,” you’ll pay for irrelevant clicks.

Fix it: Build and maintain a detailed negative keyword list from day one.

4. Using Broad Match Without Caution

Broad match terms like “investment planner” can trigger ads for completely unrelated searches.

Fix it: Use phrase or exact match for high-intent control, especially in the early stages.

5. No Conversion Tracking

If you’re not tracking calls, form fills, or booked appointments, you have no way to know what’s working.

Fix it: Set up conversion tracking properly—this is non-negotiable.

How to Think About Budget as a Financial Advisor

Your goal isn’t to get “cheap clicks.” It’s to get qualified leads that turn into AUM.

But that only works if:

Your cost per lead is predictable

Your cost per acquisition (CPA) fits your margins

You have the tracking in place to monitor both

Let’s say you charge $2,500/year per client, and retain them for 5+ years. That’s $12,500 lifetime value. A $500 cost per client might be acceptable—but only if those leads are qualified.

Without tight control? You could easily spend $2,000+ on unqualified clicks and never get a meeting.

Cost Control Checklist for Advisors

Use conversion tracking from day one

Start with a daily budget you can afford to lose while testing

Pause campaigns that don’t generate booked calls within 2–4 weeks

Use audience layering (age, income, zip code) to filter traffic

Review search terms every 48–72 hours to weed out bad queries

Don’t let Google auto-optimize everything

Don’t Let Compliance Kill Your Campaign Before It Starts

If you’re a financial advisor, you’re not just running ads—you’re operating in one of the most regulated advertising environments in the U.S.

The SEC, FINRA, and even state-level regulators all have a say in what you can and can’t say in your Google Ads and landing pages.

Unlike many industries, a single non-compliant sentence can get your ad disapproved, your account suspended, or worse—trigger a regulatory audit. This isn’t just about good marketing. It’s about legal risk management.

What Makes Financial Advisor Ads So Sensitive?

Because financial advisors deal with:

Consumer trust and life savings

Complex, high-stakes financial decisions

Heavily regulated product categories (securities, retirement plans, insurance)

Regulators are extremely strict about:

Misleading claims

Promissory language

Lack of proper disclosures

High-Risk Phrases to Avoid in Your Ads and Landing Pages

These might sound harmless to a marketer—but they’re red flags for compliance:

❌ “Guaranteed returns”

❌ “Beat the market”

❌ “Secure your financial future with us”

❌ “We’re the top-rated advisors in the U.S.”

❌ “We help clients retire early with no risk”

Even testimonials that make these claims can be non-compliant if they’re not balanced or disclosed properly.

Safer, Compliant Alternatives

✅ “Fiduciary advice tailored to your goals”

✅ “Helping clients build long-term strategies since 2010”

✅ “Transparent, fee-only planning. No commissions.”

✅ “Serving 150+ clients in the Atlanta area”

✅ “Registered Investment Advisor (RIA) | SEC Regulated”

The key is to focus on your process, transparency, and qualifications—not outcomes you can’t promise.

Disclosures You Should Always Consider

Depending on your regulatory setup (SEC-registered RIA vs. IAR under a firm), you may need to:

Add Form ADV links on your landing page

Include your legal firm name and state of registration

Clarify your fee structure if claiming “fee-only”

Add disclaimer language when quoting testimonials or performance

Avoid ranking claims (e.g. “#1 advisor in NY”) unless you can substantiate and disclose methodology

Always consult your Chief Compliance Officer (CCO) or compliance consultant before launching a new campaign.

Best Practice: Involve Compliance from the Start

The worst scenario is running a campaign that works—and then having to shut it down because it violates internal or regulatory policy.

Build a process that includes compliance review before any ad goes live.

✅ Submit ad copy and landing pages for pre-review

✅ Store compliant boilerplate language for future use

✅ Maintain an audit trail of approvals

Real Success Stories: How Financial Advisors Are Winning with Google Ads

If you’re wondering whether Google Ads can actually deliver qualified leads for financial advisors, the answer is yes—when done right.

Below are three real-life examples of firms that used strategic targeting, compliant messaging, and ongoing optimization to generate high-quality leads and measurable ROI.

Case 1: From Zero to 36 Qualified Leads/Month—Under Budget

A nationwide asset management firm launched its first Google Ads campaign with a clear objective: generate qualified financial advisory leads while maintaining strict budget controls.

What they did:

Focused on high-intent keywords tied to retirement and investment advice

Set clear geographic targeting and daily budget caps

Implemented conversion tracking for phone calls and form submissions

Results:

Averaged 36 qualified leads per month

Came in $1,700 below budget

Gained predictable lead flow without sacrificing quality

Takeaway for advisors: A tightly structured search campaign, when paired with conversion tracking, can deliver high-quality leads without budget surprises.

Case 2: 13,000+ Leads in 12 Months with a CPA of £24.23

A UK-based financial services firm ran Google Ads to aggressively grow lead volume while managing costs.

Tactics they used:

Daily optimization of search terms and negative keywords

A/B testing of compliant ad copy

Built dedicated landing pages with trust signals and lead capture

Results:

Generated 13,000+ leads over 12 months

Reduced cost per acquisition by £5.08

Increased conversion rate by 24%

Takeaway for advisors: When you manage campaign hygiene aggressively—blocking irrelevant clicks, testing creatives, refining audience—you can scale without losing efficiency.

Case 3: 253% More Conversions by Simplifying Structure

A niche-focused Google Ads consultant helped a lead-gen client (similar in structure to a financial advisory business) by consolidating a bloated campaign setup.

They took these actions:

Reduced 89 ad groups to 21

Shifted to automated bidding (Target CPA)

Streamlined ads with better responsive search ad structure

Results:

+253% more conversions year-over-year

-60% CPA

+456% conversion rate increase

Takeaway for advisors: Simplifying your Google Ads structure and leveraging Google’s automation tools (with the right guardrails) can supercharge results—even with the same budget.

Diversifying Acquisition Channels: A Smarter Strategy for Financial Advisors

While Google Ads can generate high-quality leads quickly, relying on a single channel makes your practice vulnerable to rising costs, algorithm shifts, or platform policy changes.

The most resilient and effective financial advisory firms today adopt a multi-channel acquisition strategy—where each platform plays a complementary role in the funnel.

Here’s how to build a more robust client acquisition machine:

SEO: Build Long-Term Trust and Inbound Traffic

Search engine optimization helps you capture leads who are researching before contacting an advisor. These users may not click an ad—but they do click trusted organic listings.

Tactics that work well for advisors:

Create blog content targeting queries like:

“Do I need a financial advisor in my 30s?”

“How to minimize taxes in retirement”

Optimize your Google Business Profile to rank for local searches

Build backlinks from local media, financial directories, and podcast appearances

Why it matters: SEO delivers compounding ROI and enhances your credibility when users Google your name after seeing an ad elsewhere.

Meta Ads: Perfect for Retargeting and Education

While cold prospecting to HNW individuals via Meta (Facebook/Instagram) is tricky, Meta Ads shine as a warm-layer channel.

Best use cases:

Retargeting website visitors who came from Google Ads but didn’t convert

Promoting educational content such as “5 Tax Mistakes to Avoid in Retirement”

Driving registrations to webinars, free assessments, or retirement checklists

Why it matters: Meta builds repetition and recall, warming up leads who may need multiple exposures before contacting you.

The primary objective of any ad is to capture attention—and in that regard, these Facebook ads succeed.

LinkedIn Ads: Direct Access to Business Owners and Professionals

LinkedIn is the only platform where you can target by job title, company size, and industry—perfect for advisors focused on niches like tech employees, doctors, or small business owners.

Effective strategies include:

Promote lead magnets tailored to specific professions (e.g., “Wealth Planning for Physicians”)

Run Message Ads offering a free consultation or tax planning session

Target company founders in your region using “Job Title + Geography” filters

Why it matters: LinkedIn offers laser-targeted outreach to pre-qualified prospects with significant investable assets.

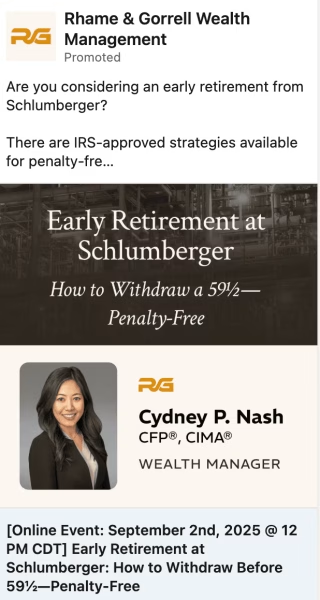

A clever and strategic ad that promotes valuable content (through a live event) rather than directly advertising financial advisory services.

Once prospects are engaged, you can guide them further down the funnel.

Email Marketing: Maximize Conversion and Referrals

Once you’ve captured emails from Meta, LinkedIn, or your website, nurture them with an automated sequence.

Must-have email flows:

A 5-day onboarding series after a webinar or lead magnet

Monthly newsletters with market insights or personal finance tips

Periodic client stories (with permission) to build social proof

Why it matters: For financial advisors, trust builds over time.

Email allows consistent, low-cost touchpoints that drive conversions and referrals over months, not days.